Explore Expert Funding Providers for a Smooth Loaning Experience

In the world of monetary transactions, the quest for a smooth loaning experience is often demanded yet not quickly obtained. Professional lending services supply a pathway to navigate the intricacies of borrowing with precision and experience. By straightening with a trustworthy car loan provider, individuals can open a plethora of benefits that prolong beyond simple monetary deals. From tailored funding solutions to personalized guidance, the world of specialist finance solutions is a realm worth discovering for those looking for a borrowing journey noted by efficiency and ease.

Advantages of Professional Loan Solutions

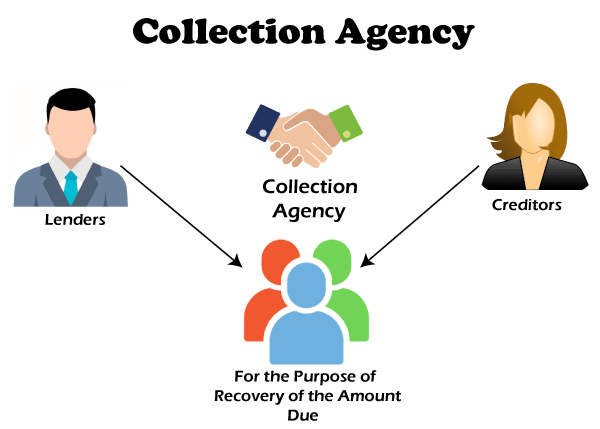

Expert funding solutions supply know-how in navigating the complicated landscape of loaning, providing tailored services to meet details monetary demands. Professional funding solutions often have actually developed connections with lenders, which can result in faster authorization processes and better settlement results for customers.

Selecting the Right Car Loan Provider

Having actually recognized the benefits of expert funding services, the following crucial step is picking the best car loan carrier to meet your particular economic requirements successfully. business cash advance lenders. When selecting a car loan provider, it is important to take into consideration several crucial elements to guarantee a smooth loaning experience

To start with, evaluate the reputation and credibility of the finance carrier. Research consumer reviews, rankings, and testimonies to gauge the satisfaction levels of previous consumers. A respectable loan company will certainly have transparent conditions, excellent customer support, and a track document of integrity.

Second of all, compare the rates of interest, costs, and repayment terms provided by different financing service providers - top merchant cash advance companies. Look for a carrier that supplies affordable prices and flexible settlement options tailored to your monetary scenario

In addition, take into consideration the funding application procedure and authorization duration. Select a provider that supplies a streamlined application process with quick authorization times to access funds immediately.

Improving the Application Process

To enhance performance and ease for candidates, the lending service provider has actually applied a structured application procedure. This refined system aims to streamline the borrowing experience by decreasing unnecessary documentation and accelerating the approval process. One vital function of this streamlined application process is the online system that permits applicants to submit their information electronically from the comfort of their own homes or offices. By eliminating the need for in-person brows through to a physical branch, candidates can save time and complete the application at their benefit.

Comprehending Financing Conditions

With the structured application procedure in place to streamline and speed up the browse around here loaning experience, the next important step for applicants is gaining an extensive understanding of the loan terms and problems. Understanding the terms and conditions of a car loan is important to make sure that consumers are mindful of their obligations, civil liberties, and the overall expense of loaning. By being well-informed regarding the lending terms and problems, consumers can make sound monetary choices and browse the borrowing process with self-confidence.

Taking Full Advantage Of Loan Approval Possibilities

Safeguarding approval for a finance demands a tactical technique and detailed preparation for the debtor. To maximize funding authorization chances, individuals must start by evaluating their credit rating reports for accuracy and dealing with any type of disparities. Keeping an excellent credit report is vital, as it is a substantial variable taken into consideration by lending institutions when assessing creditworthiness. In addition, minimizing existing financial obligation and preventing handling new debt prior to making an application for a loan can show economic obligation and enhance the possibility of approval.

In addition, preparing an in-depth and reasonable budget that details earnings, expenses, and the suggested car loan repayment strategy can showcase to loan providers that the customer can handling the additional economic obligation (top merchant cash advance companies). Providing all required documentation quickly and precisely, such as proof of earnings and employment history, can enhance the approval procedure and infuse self-confidence in the lending institution

Final Thought

In final thought, expert financing services provide various benefits such as professional support, customized loan options, and enhanced authorization opportunities. By selecting the ideal funding provider and understanding the terms and problems, borrowers can simplify the application procedure and make certain a smooth borrowing experience (Loan Service). It is essential to very carefully take into consideration all facets of a funding prior to devoting to ensure monetary security and effective settlement